SEC says your token sale is probably a securities offering

The United States Securities and Exchange Commission (“SEC”) has opened the door to regulate initial coin offerings (“ICOs”) also called a token sale to U.S. investors. The SEC suggests they will regulate the digital world of the 21st century just as they would regulate a plain vanilla 20th century company offering equity to investors.

On July 25, 2017 the SEC issued its report regarding decentralized autonomous organizations and their issuance of initial coin offerings via block chain technology to individuals in the United States.

The company at issue in the report is named, The DAO — not to be confused with the general term decentralized autonomous organization. This article will cut to the chase on the SEC report.

Here are the highlights:

ICOs could be considered an “investment contract” and you should assume they will be.

An investment contract is determined by a 4-part test

1. Investment of money (according to SEC crypto-currency is money)

2. Common enterprise (i.e. the same business goal)

3. Reasonable expectation of profits (the investment is not for charity or a gift)

4. Managerial efforts of others (SEC found investors relied on The DAO, Slock.it, and The DAO Curators to generate profits for investors)

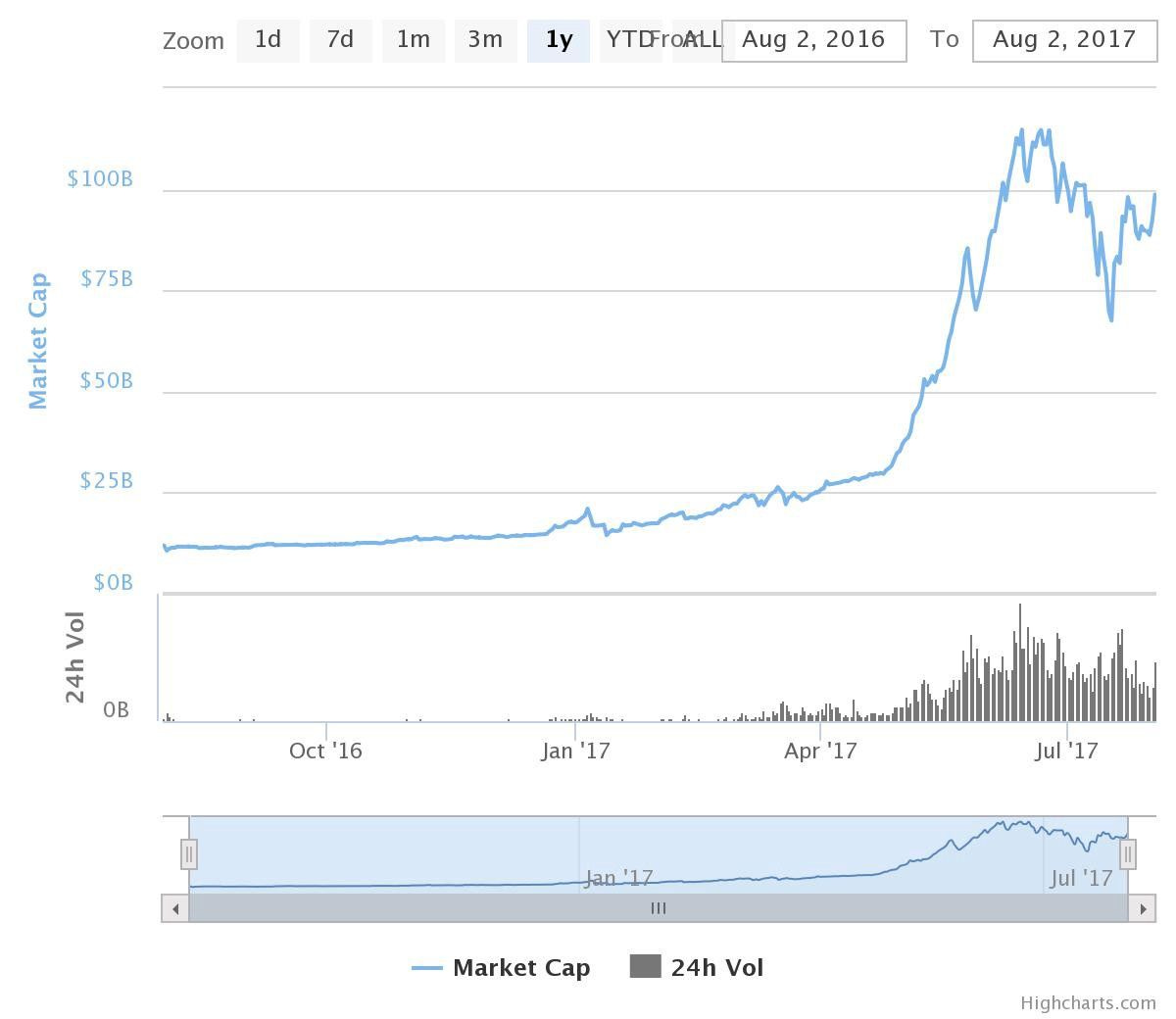

As the chart above makes clear, serious money is flowing into the crypto-currency space and the industry is reaping the benefits along with the regulatory scrutiny that comes from such increased interest.

The Bottom Line:

Regulators across the globe are taking serious interest in blockchain technology and crypto-currencies. A company seeking to use an ICO or token sale to raise money should expect the SEC report to be a harbinger of the coming cascade of global regulatory announcements that may adapt the local law status quo approach mirroring the SEC in the United States.